Using eDesk, you can automatically generate invoices and credit notes for your customers using the Amazon VAT Calculation Service. These can be generated for VAT orders within the EU, using the tax and order information received directly from Amazon.

This help file will guide you through what the Amazon VAT Calculation Service is and how you can use it to start automating invoicing in eDesk.

Before you start

- You’ll need to have access to Invoice Template in your Settings in order to view, create and edit templates. If you don’t have access, you can request it from an Admin user within your business.

- You'll need to participate in the Amazon VAT Calculation Service (VCS). To find out more about this, click here.

01 What is the Amazon VAT Calculation Service (VCS)?

The Amazon VAT Calculation Service (VCS) ensures that invoices are generated by sellers within 24 hours of the order being placed. Once they have been generated, the invoices are then available to the buyer, within the Order Information section on Amazon.

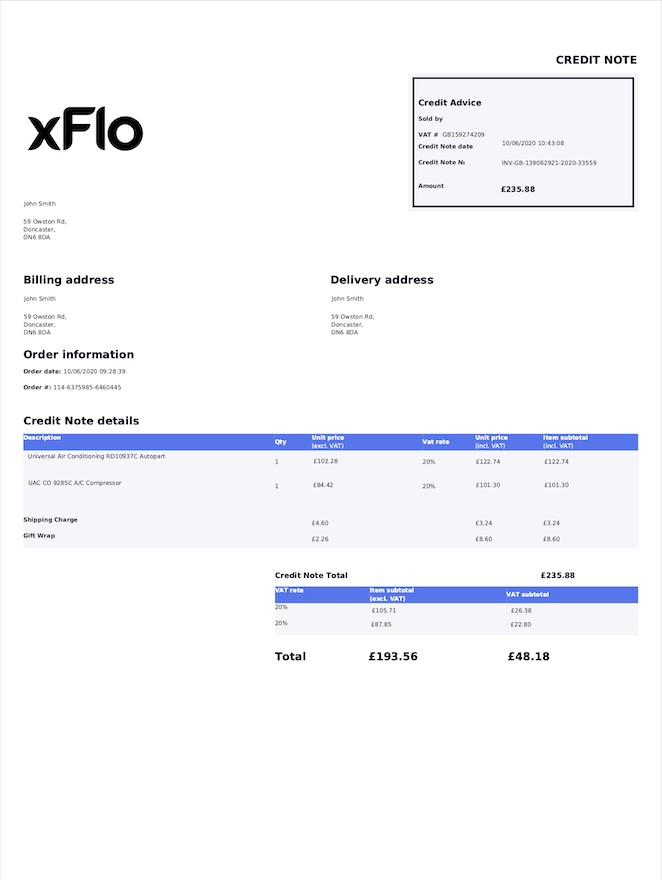

Note: The VCS feature also supports Credit Notes, these will be issued with a refund. Currently, Amazon automates invoice generation using their own service (VCS). They also integrate with a number of 3rd parties, so that other services can generate the invoices - which is what eDesk is doing. Invoices are generated in eDesk using Amazon reports to populate the information.

Currently, Amazon automates invoice generation using their own service (VCS). They also integrate with a number of 3rd parties, so that other services can generate the invoices - which is what eDesk is doing. Invoices are generated in eDesk using Amazon reports to populate the information.

This ensures that all information is exactly how it appears on Amazon, and unlike our own invoice generator, it will have all VAT information.

02 How do I start using Amazon Invoicing in eDesk?

Amazon VCS is currently supported on 5 marketplaces - UK, DE, FR, IT, and ES. To get started with it, you must opt into the VCS program and enable the Invoice Generation setting.

-

Go to the VAT Calculation Settings section in Seller Central and select Change your VAT settings.

-

Here you can Enroll in the VAT Calculation Service and update your company VAT details.

-

Once enrolled, go to the Invoice Generation section and select I will upload my own VAT invoices, to allow eDesk to upload invoices on your behalf.

-

If the seller doesn't have their tax information added or up to date, the invoices will fail to generate or will contain incorrect information.

-

If you are dispatching orders from multiple countries, you must enter a VAT number for each one of them. If no VAT number is entered, the VAT will not be calculated and an invoice will not be generated.

-

Product Tax Codes (PTC) are required to generate the invoice. If a PTC has not been entered for each product, the default one selected when activating VCS will be used. If the tax information is not available, the invoice will not be generated.

- If an invoice fails to generate for any reason, the eDesk admin user will receive an email notification and the invoice must then be manually updated in Amazon.

03 eDesk Settings

- Go to Settings → Smart Tools → Invoice Templates.

- Create an invoice for each one of your Amazon channels.

For more information on creating Invoice Templates, click here.

Note: tax codes must be added for all products in order for the invoice to be generated. If the tax information is not available, the invoice will not be generated and must be manually updated in Seller Central.

The invoice will be uploaded every hour to ensure buyers receive an invoice within 24 hours of placing their order, which will help to keep your Invoice Defect Rate down. This is very important as if your IDR creeps above 5%, Amazon could suspend your account.

04 Sending Credit Notes and Invoices

Credit notes and invoices will automatically be uploaded to Amazon where the buyer can access and download them.

You can also send the invoices and credit notes manually from eDesk using the Reply box option or the option on the right-hand nav.

If there are multiple items in the order, each invoice will be available on Amazon for the buyer to download. You will also be able to select which document to send within your eDesk account.

Further Readings

If you would like to find out more about creating Invoice Templates with eDesk, click here.

Interested in learning how to connect Amazon with eDesk? Click here.